Media Contact: Beth McGroarty

beth.mcgroarty@globalwellnessinstitute.org • +1.213.300.0107

WELLNESS NOW A $3.72 TRILLION GLOBAL INDUSTRY – WITH 10.6% GROWTH FROM 2013-2015

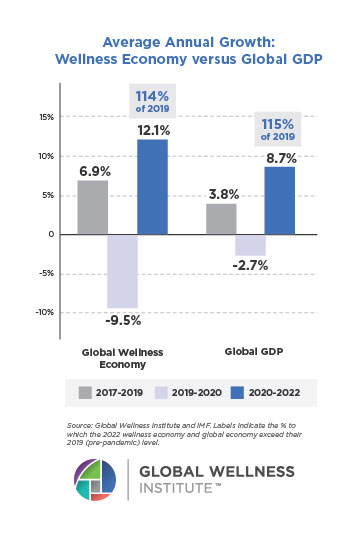

New Global Wellness Institute research confirms wellness is one of the world’s fastest-growing, most resilient markets – clocking double-digit growth while the global economy shrank by -3.6%

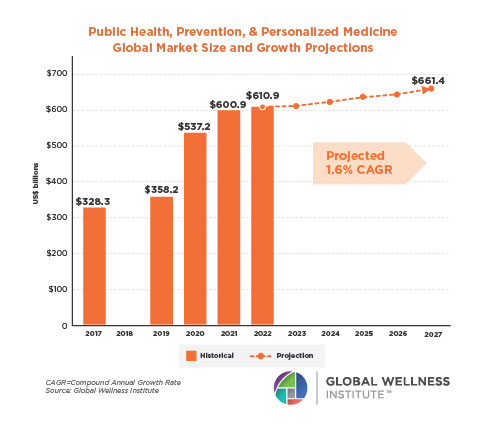

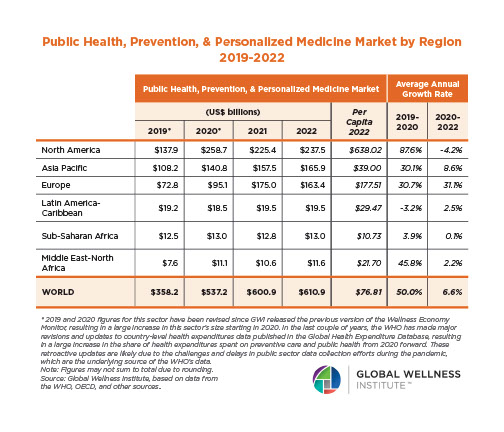

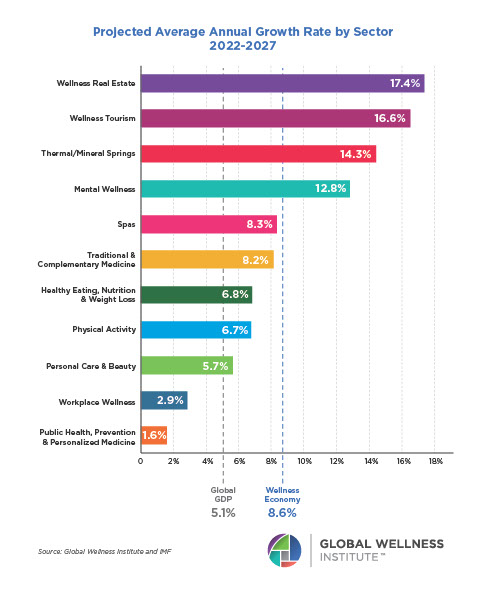

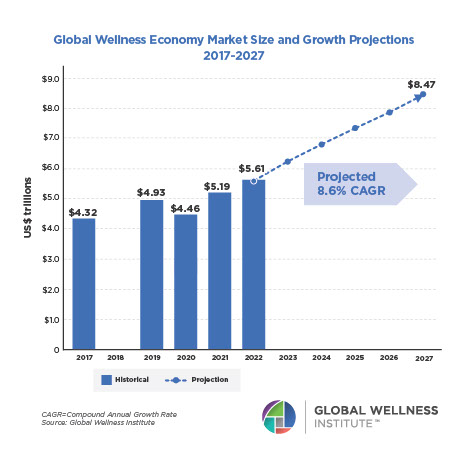

Kitzbühel, Austria – October 17, 2016 – The global wellness industry grew 10.6% in the last two years, from a $3.36 trillion market in 2013 to $3.72 trillion in 2015, according to research released today by the Global Wellness Institute (GWI). This new data on the ten markets that comprise the global wellness “cluster” provides fresh evidence that wellness is one of the world’s largest, fastest growing, and most resilient markets.

Economic context:

• From 2013-2015, the global wellness sector registered double-digit growth, while the global economy/GDP shrank by -3.6%* – a “growth gap” of nearly 15%.

• The wellness industry now represents 5.1% of global economic output.

• Wellness expenditures are now nearly half as large as total global health expenditures ($7.6 trillion**).

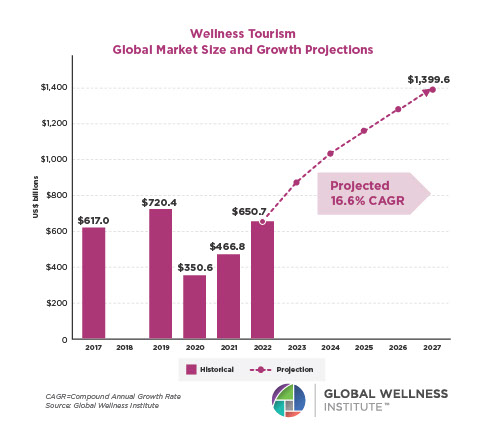

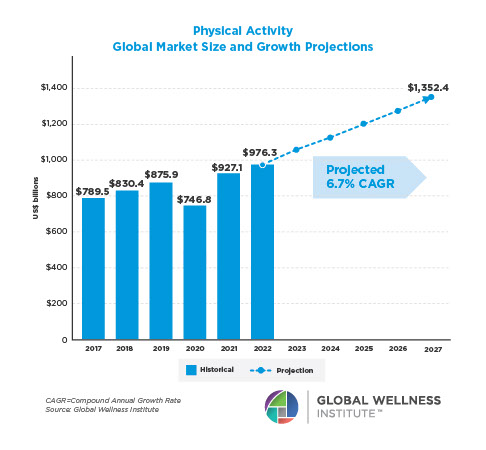

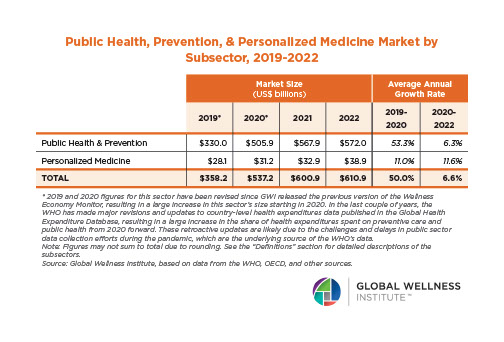

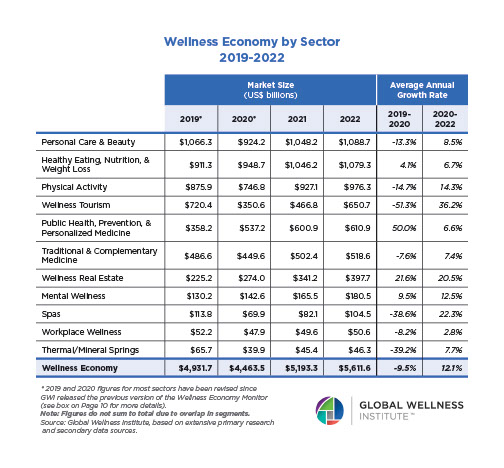

Among the ten wellness markets analyzed,*** the fastest growing from 2013-2015 were: 1) Preventative/Personalized Medicine & Public Health (+23.5%), 2) Fitness & Mind-Body (+21.4%), 3) Wellness Lifestyle Real Estate (+18.6%), 4) Wellness Tourism (+14%), and 5) Healthy Eating, Nutrition & Weight Loss (+12.8%).

These topline numbers were released today at the 10th annual Global Wellness Summit being held in Kitzbühel, Austria, which has attracted 500 industry leaders from 45 nations. The in-depth report, the 2016 Global Wellness Economy Monitor, with detailed data on regional and national wellness markets, will be released in early 2017.

“Recent years have been marked by global economic contraction and disruptive geopolitical events, but a ‘wellness economy’ just keeps rising, with an upward trajectory that seems unstoppable,” said Ophelia Yeung, Senior Research Fellow, GWI. “And we predict that consumers, governments and employers will continue to spend big on wellness because of these megatrends: an emerging global middle class, a rapidly aging world population, a chronic disease and stress epidemic, the failure of the ‘sick-care’ medical model (resulting in uncontrollable healthcare costs), and a growing subset of (more affluent, educated) consumers seeking experiences rooted in meaning, purpose, authenticity and nature.”

Global Wellness Markets – 2013-2015

Note: Growth percentages are conservative, as revenues are reported in U.S. dollars,

which appreciated significantly from 2013-2015 against the currencies of major wellness markets, including the Euro, Russian Ruble, Canadian Dollar, Japanese Yen, Indian Rupee and Brazilian Real.

2013 revenues – 2015 revenues

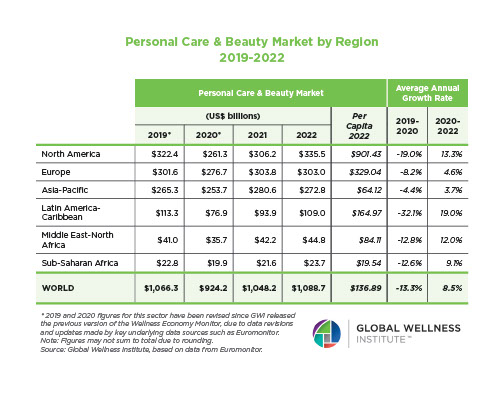

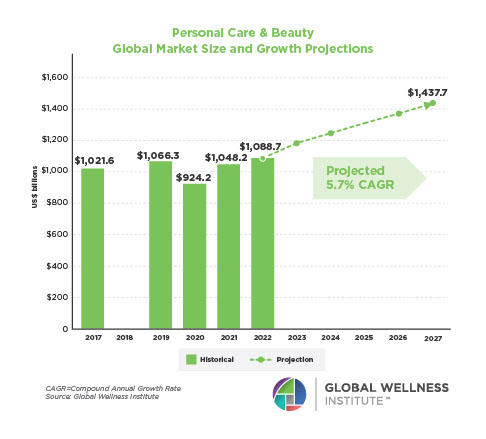

- Beauty and Anti-Aging: $1.02 trillion – $999 billion

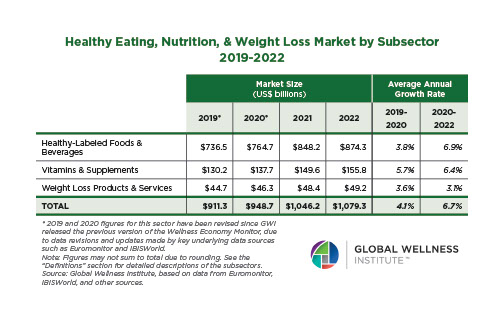

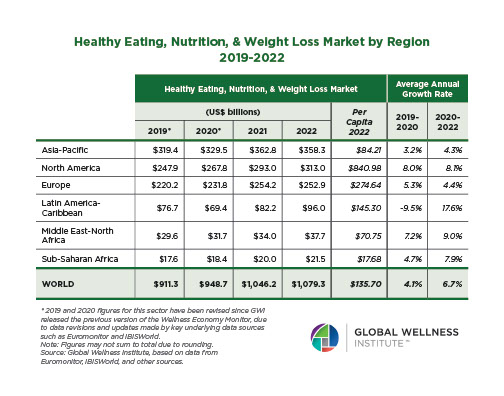

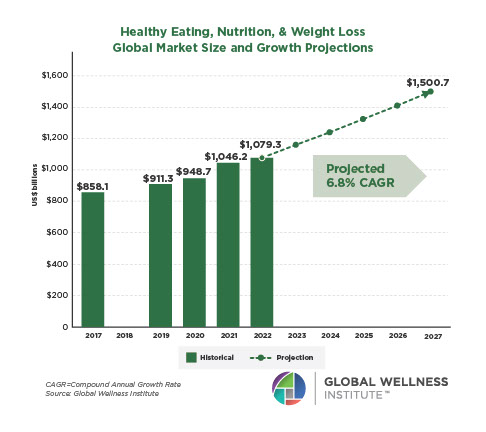

- Healthy Eating, Nutrition & Weight Loss: $574.2 billion – $647.8 billion

- Wellness Tourism: $494.1 billion – $563.2 billion

- Fitness & Mind-Body: $446.4 billion – $542 billion

- Preventative & Personalized Medicine & Public Health: $432.7 billion – $534.3 billion

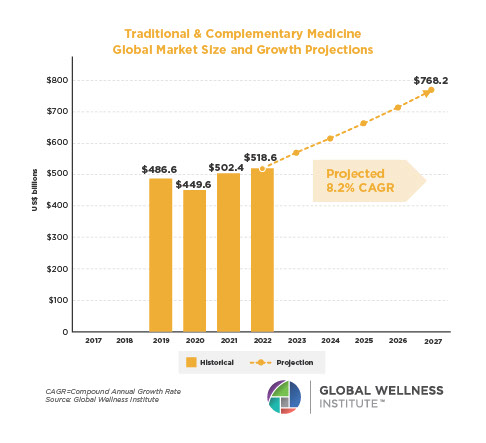

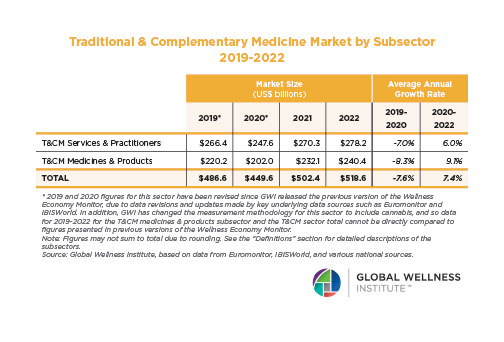

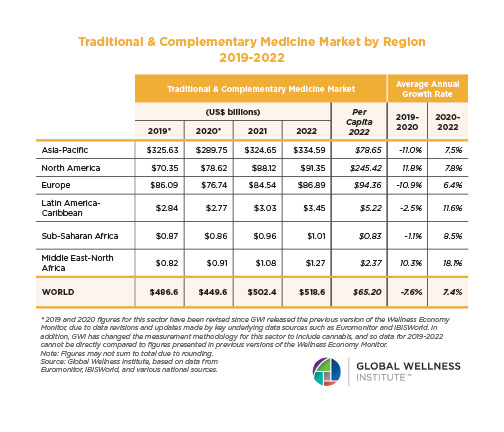

- Complementary & Alternative Medicine: $186.7 billion – $199 billion

- Wellness Lifestyle Real Estate: $100 billion – $118.6 billion

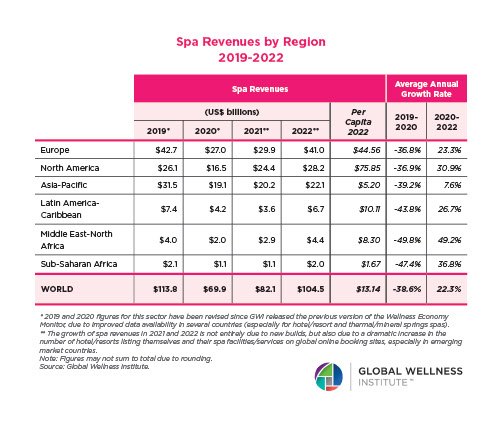

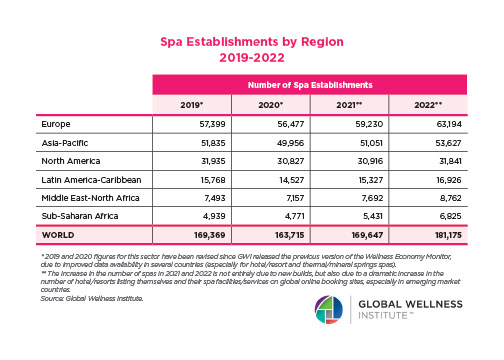

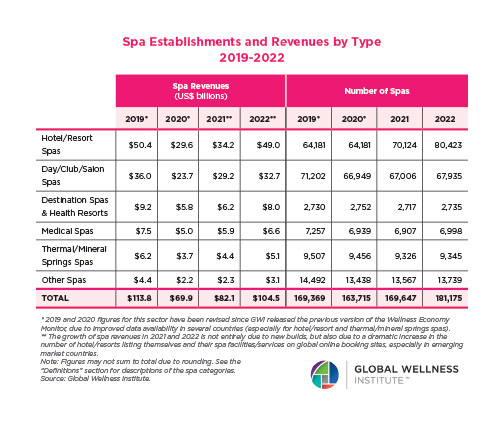

- Spa Industry: $94 billion – $98.6 billion

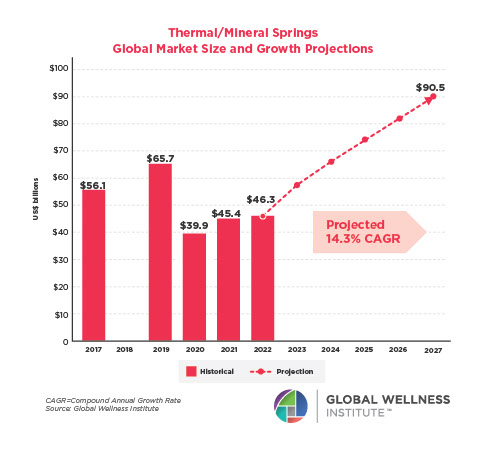

- Thermal/Mineral Springs Facilities: $50 billion – $51 billion

- Workplace Wellness: $40.7 billion – $43.3 billion

Spotlight on 5 Markets (Original GWI Data):

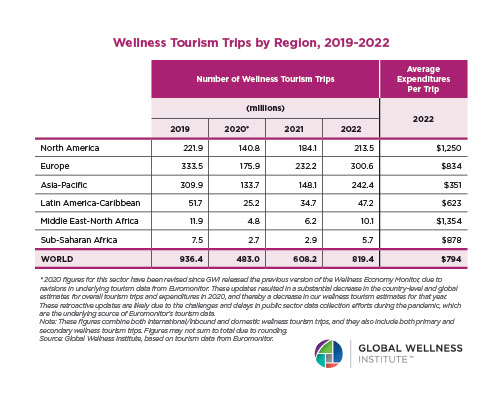

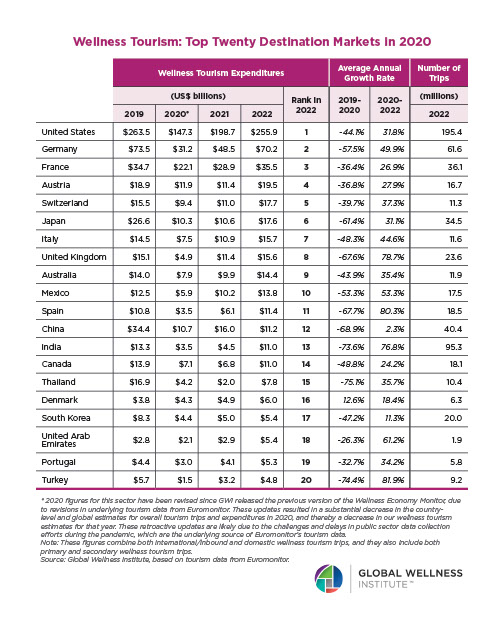

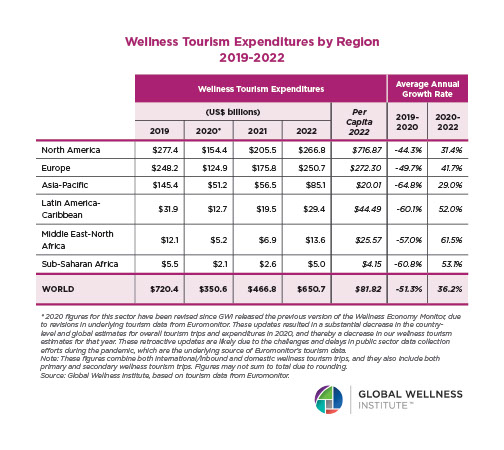

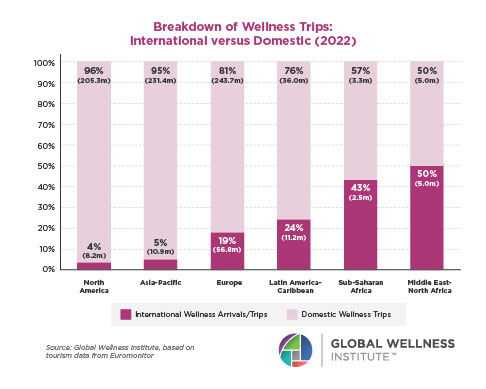

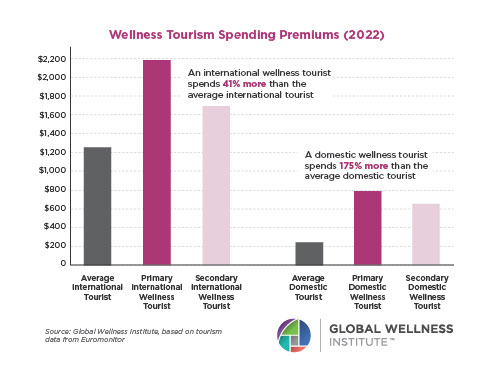

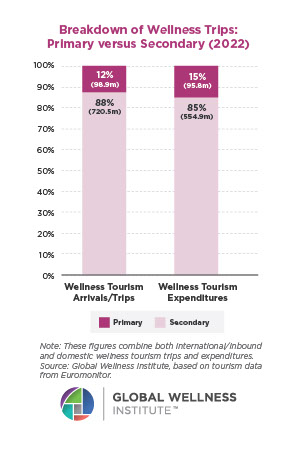

Wellness Tourism: From 2013-2015, wellness tourism revenues grew 14%, more than twice as fast overall tourism expenditures (6.9%). World travelers made 691 million wellness trips in 2015, 104.4 million more than in 2013. Wellness tourism now accounts for 15.6% of total tourism revenues – nearing 1 in 6 of total “tourist dollars” spent. That’s, in part, because wellness travelers spend much more per trip: international wellness tourists spend 61% more ($1,613/trip) than the average international tourist, and the premium for domestic wellness travelers is even higher: $654 per trip, 164% higher than the typical domestic tourist. Wellness tourism is responsible for 17.9 million jobs worldwide.

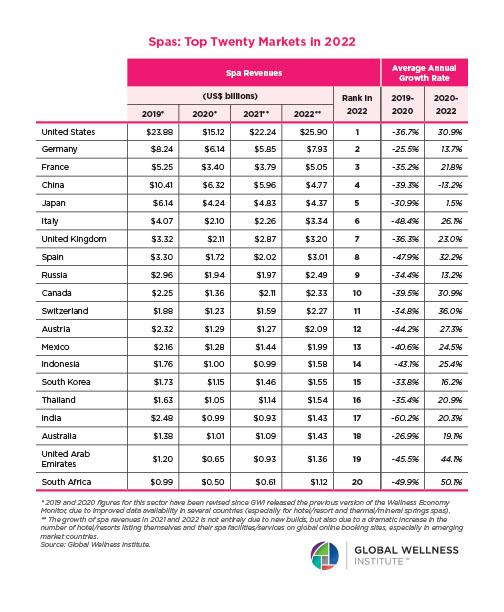

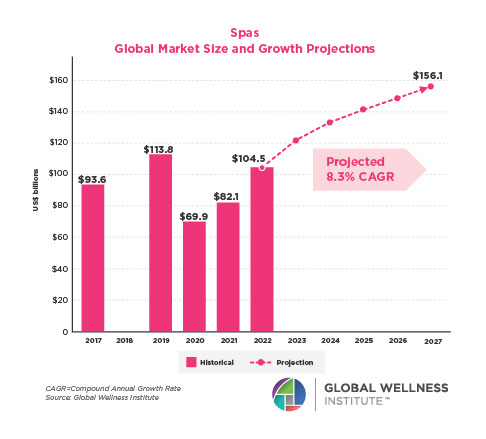

Spa Industry: The spa economy, including spa facility revenues ($77.6 billion), and also education, consulting, associations, media, and event sectors that enable spa businesses ($21 billion), grew to $98.6 billion market in 2015. Spa locations jumped from 105,591 in 2013 to 121,595 in 2015. Since 2013, the industry has added 16,000 spas, more than 230,000 workers (to reach 2.1 million), and $3.5 billion in revenue. The modest 2.3% annual revenue growth rate (2013-2015) is largely due to the U.S. dollar currency conversion from large spa markets across Europe and Asia. If global spa facility revenues are converted to the Euro, the market actually grew a robust 25%: from €56 billion to €70.1 billion.

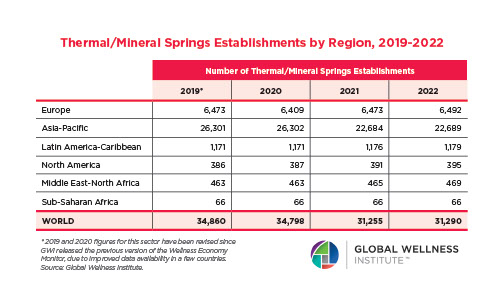

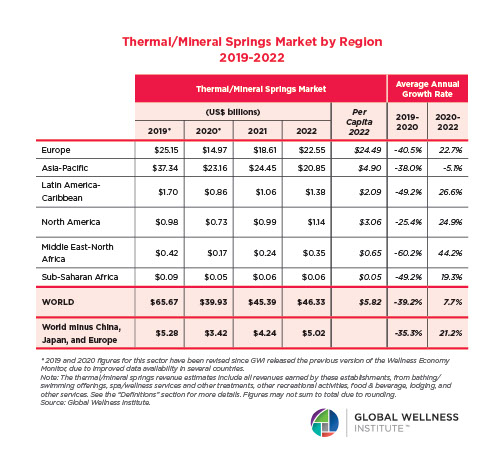

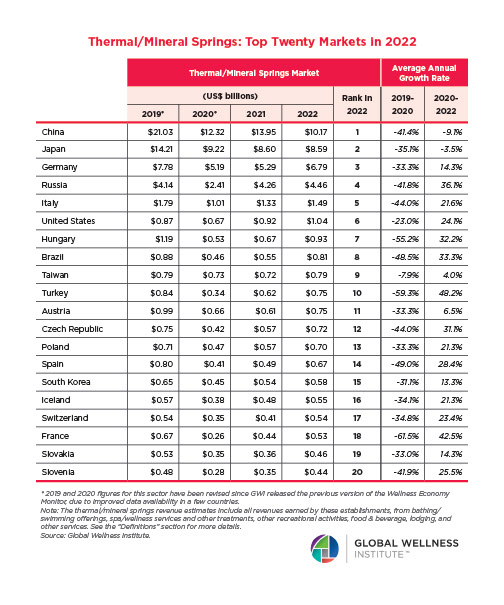

Thermal & Mineral Springs: The number of revenue-earning thermal/mineral springs properties grew from 26,847 in 2013 to 27,507 in 2015 – a gain of 660 facilities across 109 countries. These businesses earned $51 billion in 2015, up 2% from 2013. While this gain looks modest, GWI research finds rapidly rising consumer interest in springs-based activities – and 2015 revenues are heavily impacted by the depreciation of European currencies against the dollar, as Europe represents 39% of industry revenues.

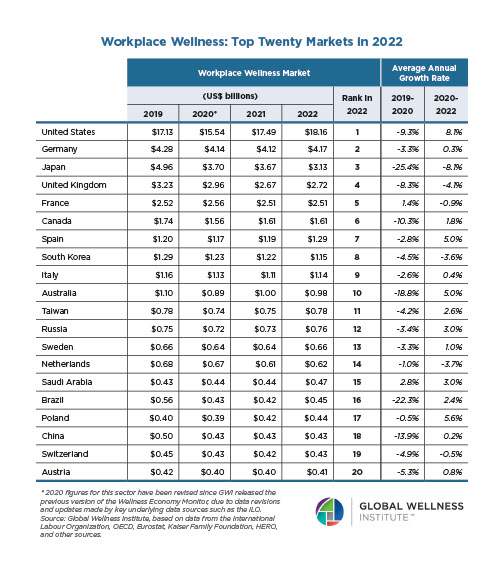

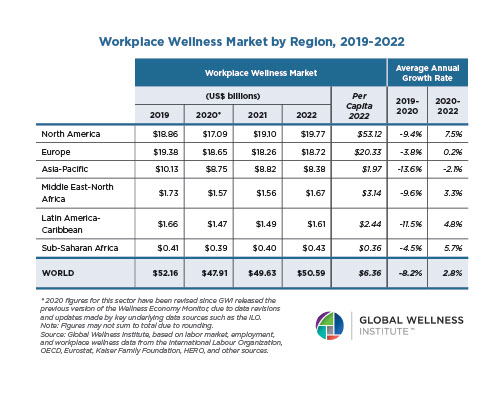

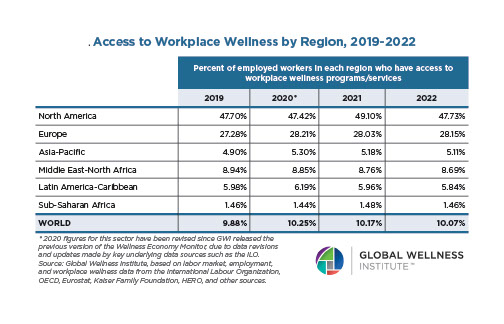

Workplace Wellness: As the cost of unwell workers skyrockets (reaching 10-15% of global economic output), employers are spending more on employee wellness each year. The global industry grew 6.4% from 2013-2015, to $43.3 billion. But two-thirds of that spend is concentrated in North America ($16.2 billion) and Europe ($16.1 billion). And the GWI estimates that with only 9.5% of today’s workforce covered by a workplace wellness program, this remains a wellness market with some of the largest growth opportunity.

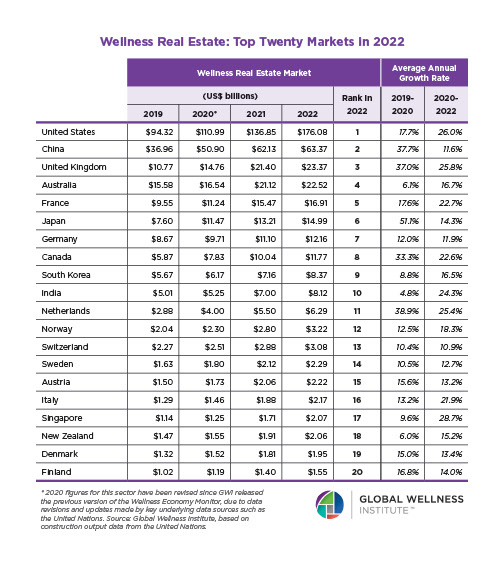

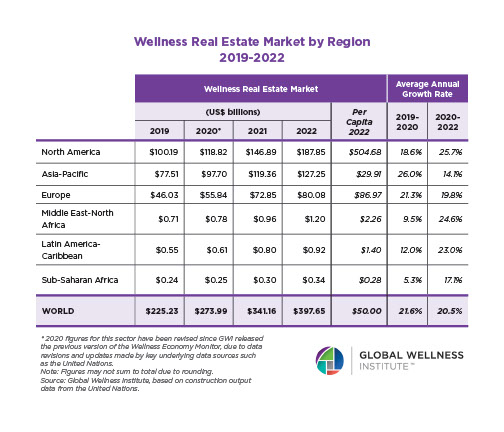

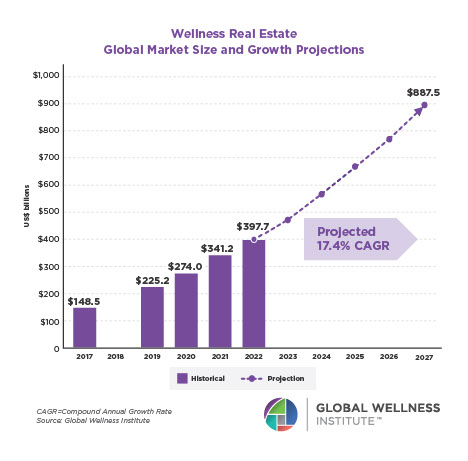

Wellness Lifestyle Real Estate: The market for residential, hospitality, and mixed-used real estate that incorporates wellness elements (i.e., human, social and environmental health) into its design, construction, amenities and services, was one of the fastest-growing wellness sectors from 2013-2015: growing 19% to $118.6 billion.

Wellness Market Forecast 2020:

“A profound shift in the way people consume wellness is underway: once a luxury or ‘add-on’, it’s now being infused into every aspect of daily life – from how people work to how they travel,” noted Katherine Johnston, Senior Research Fellow, GWI. “And the spend on proactive healthy choices – on wellness – will continue to comprise a greater percentage of massive multi-trillion industries, whether real estate, food and beverage, or travel.”

Research Sponsors: The 2016 Global Wellness Economy Monitor was underwritten with support from the following industry leaders: Spafinder Wellness, Biologique Recherche, Universal Companies, Elemis, HydraFacial, Miraval, Performance Health, The BodyHoliday, Treatwell and Two Bunch Palms.

For more information, or to speak to GWI researchers, contact Beth McGroarty: beth.mcgroarty@globalwellnessinstitute.org or (+1) 213-300-0107.

About the Global Wellness Institute:

The Global Wellness Institute (GWI), a non-profit 501(c)(3), is considered the leading global research and educational resource for the global wellness industry, and is known for introducing major industry initiatives and regional events that bring together leaders and visionaries to chart the future. GWI positively impacts global health and wellness by advocating for both public institutions and businesses that are working to help prevent disease, reduce stress, and enhance overall quality of life. Its mission is to empower wellness worldwide. www.globalwellnessinstitute.org

*Global GDP data: IMF, World Economic Outlook Database, 2016

** WHO, Global Health Expenditures Database, 2014

*** The GWI develops original data for five sectors: wellness tourism, spa, thermal/mineral springs, workplace wellness and wellness lifestyle real estate. For the other 5 sectors, secondary global industry data is evaluated and aggregated.

**** Based upon economic sector projections from the IMF, ILO, Euromonitor, and GWI’s data/projection model.